The forex market operates 24 hours a day, five days a week, across four major trading sessions. Understanding the specific market hours and trading sessions is crucial for successful forex trading. This article explores the opening and closing times of the forex market, the best times to trade, and the impact of weekends and holidays on trading activities.

Key Takeaways

- The forex market operates 24 hours a day, five days a week, across four major trading sessions.

- Each major trading session opens at a different time, with the New York session opening at 8am EST for US-based traders.

- The most active trading hours are during the overlap of the New York and London sessions from 8am to 12pm EST.

- Forex markets are closed between Friday 5pm EST and Sunday 5pm EST, impacting trading activities.

- There is an overlap between stock market and forex market opening hours, with forex markets operating 24 hours a day, five days a week.

Understanding Forex Market Hours

Overview of Forex Market Operation

The Forex market is unique in that it operates 24 hours a day, five days a week. This round-the-clock trading is possible because the market spans multiple time zones, allowing traders to respond to global economic events as they occur in real time. The market opens on Sunday evening in Sydney, Australia, and closes on Friday evening in New York, USA.

Forex trading sessions are based in four major financial centers:

- Sydney

- Tokyo

- London

- New York

Each session has its own characteristics and trading volume, influenced by the economic activities of the region it represents. It's important for traders to be aware of the opening times of each session to plan their trading strategies accordingly.

While the market is open 24/5, not all hours are equally active. Traders often seek to capitalize on periods of higher liquidity, which typically occur during session overlaps or economic news releases.

Major Forex Trading Sessions

The currency market trading landscape is dominated by four major sessions, each with its own unique characteristics and trading volumes. The London session is renowned for being the most volatile, as it overlaps with both the Tokyo and New York sessions, leading to a significant increase in trading activity.

- New York Session: 8am – 5pm EST

- London Session: 3am – 12pm EST

- Tokyo Session: 7pm – 4am EST

- Sydney Session: 5pm – 2am EST

The New York session is the second busiest, with high trading volumes when it coincides with the London session. Conversely, the Sydney and Tokyo sessions are generally less volatile, with the Tokyo session marking the start of trading after the weekend and the Sydney session being influenced mainly by Australian market activities.

The strategic importance of session overlaps cannot be overstated. They are periods of heightened trading volume and liquidity, making them potentially lucrative times for traders to capitalize on currency market movements.

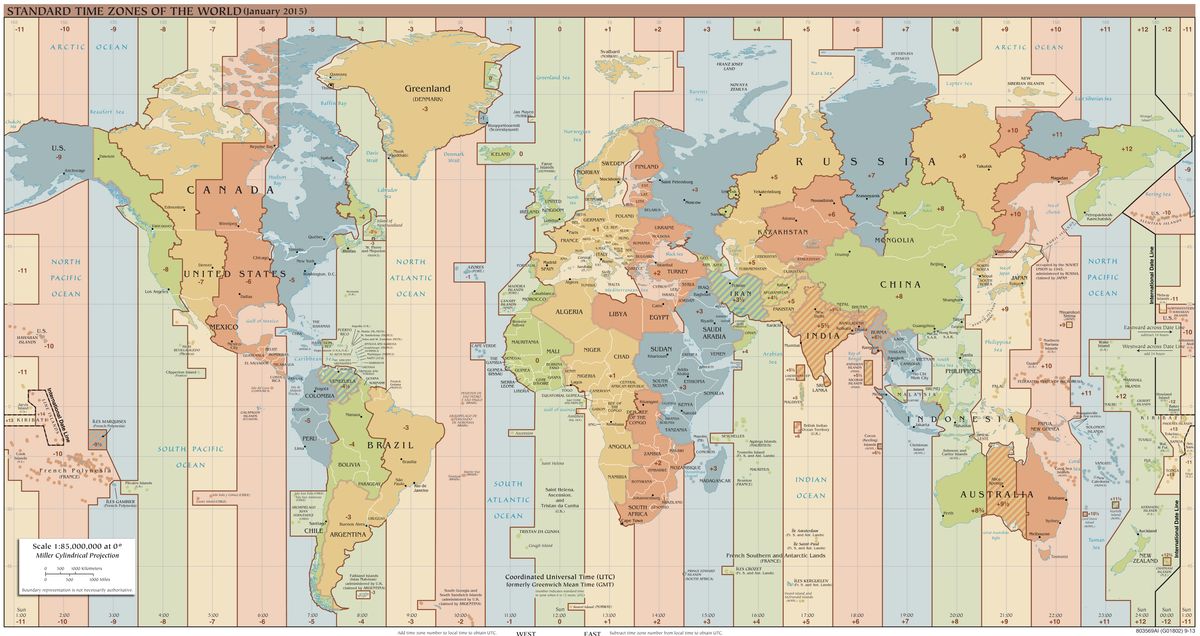

Forex Market Time Zone Converter

The Forex Market Time Zone Converter is an essential tool for traders to synchronize their trading strategies with the global forex market hours. It provides a visual representation of when the major forex trading sessions are active in relation to your local time.

- New York Session: 8am

- London Session: 3am

- Tokyo Session: 7pm

- Sydney Session: 5pm

All times are listed in Eastern Standard Time (EST).

By understanding the time zone differences, traders can better plan their trading activities to coincide with periods of high liquidity and market movement.

The converter also highlights the best times to trade in different time zones, from EST to Hawaii-Aleutian Standard Time (HST), ensuring that traders can find the optimal window for their forex market activities.

Key Trading Sessions and Their Characteristics

New York Session

The New York session is a pivotal period in the Forex market, as it marks the start of the final major trading session of the day. It operates from 8:00 AM to 5:00 PM Eastern Standard Time (EST), Monday through Friday, aligning with the business hours of the financial capital of the world, New York City.

During this session, traders can experience significant market movements, particularly when economic reports are released. The session is known for its high liquidity, especially during the overlap with the London session from 8:00 AM to 12:00 PM EST, where trading volume peaks.

The New York session is not only influential due to the presence of American financial markets but also because it overlaps with other major sessions, creating periods of heightened trading activity.

Here are the opening and closing times for the New York session across different U.S. time zones:

| Time Zone | Opening Time | Closing Time |

|---|---|---|

| EST | 8:00 AM | 5:00 PM |

| CST | 7:00 AM | 4:00 PM |

| MST | 6:00 AM | 3:00 PM |

| PST | 5:00 AM | 2:00 PM |

| AKST | 4:00 AM | 1:00 PM |

It's important for traders to be aware of these times to optimize their trading strategies around periods of high market activity.

London Session

The London session is pivotal in the Forex market, often considered the most active and liquid due to the vast number of currency pairs traded. It operates from 8 AM to 6 PM GMT, capturing the business hours of Europe and overlapping with other major sessions, which can lead to increased trading volume and liquidity.

During this session, traders can expect significant movement in the EUR/USD, GBP/USD, and other European currency pairs. The overlap with the New York session, from 1 PM to 5 PM GMT, is particularly noteworthy for its high liquidity and potential for more substantial price movements.

The London session's overlap with New York and Tokyo sessions creates windows of heightened activity that are crucial for traders to monitor.

Here are the key overlaps involving the London session:

- New York and London: 1 PM until 5 PM GMT

- London and Tokyo: 8 AM until 10 AM GMT

Adjustments for daylight savings can affect these times, so traders should use a Forex market time zone converter to stay updated.

Tokyo Session

The Tokyo session, representing the Asian market, is the first to open after the weekend, setting the initial tone for currency valuation that other sessions respond to. It operates from 11 PM to 9 AM GMT, which corresponds to 8 AM until 6 PM local time. This session is known for its relatively lower trading volume compared to the London and New York sessions, but it still offers significant opportunities, especially for currency pairs involving the Japanese Yen.

The Tokyo session is particularly important for traders dealing with Asian currencies, as economic releases during this time can lead to substantial volatility.

Here are the local times for the Tokyo session across various US time zones:

| Time Zone | Open | Close |

|---|---|---|

| EST | 7 PM | 4 AM |

| CST | 6 PM | 3 AM |

| MST | 5 PM | 2 AM |

| PST | 4 PM | 1 AM |

Keep in mind that these times can shift slightly due to daylight saving changes. Traders should be aware of the overlap periods, particularly with the Sydney session from 1 AM until 7 AM GMT, which can lead to increased liquidity and volatility.

Sydney Session

The Sydney session marks the start of the forex trading day, setting the tone for currency market fluctuations. It opens at 10 PM GMT (9 AM local time) and closes at 8 AM GMT (7 PM local time), capturing the early part of the Asian trading day. This session is known for its smaller volume compared to the New York and London sessions, but it still offers significant opportunities, especially in currency pairs involving the Australian dollar (AUD).

The Sydney session's quieter market environment can be an advantage for traders looking to execute trades with less slippage and tighter spreads.

Key characteristics of the Sydney session include:

- A focus on Australasian currency pairs such as AUD/USD and NZD/USD.

- Overlap with the Tokyo session between 11 PM and 8 AM GMT, which can lead to increased liquidity and volatility for Asian currency pairs.

- A period that is less influenced by news events from the US and Europe, providing a more stable trading environment for certain strategies.

Optimal Trading Times

Best Times to Trade Forex

Determining how to trade forex effectively involves understanding the optimal trading times. The best time to trade forex, particularly in the United States, is during the overlap of the New York and London sessions, which occurs from 8:00 AM to 12:00 PM Eastern Standard Time (EST). This period is characterized by high liquidity and significant price movements, offering traders more opportunities for profitable trades.

The heightened activity during these hours is due to the simultaneous participation of both European and American traders, making it a prime time for forex transactions.

Here is a quick reference for the best times to trade forex across different US time zones:

| Time Zone | Best Time to Trade Forex |

|---|---|

| EST | 8:00 AM - 12:00 PM |

| CST | 7:00 AM - 11:00 AM |

| MST | 6:00 AM - 10:00 AM |

| PST | 5:00 AM - 9:00 AM |

| AKST | 4:00 AM - 8:00 AM |

| HST | 3:00 AM - 7:00 AM |

It's important for traders to be aware of these times to maximize their chances of executing successful trades. While these are the most active hours, traders should also consider their personal trading style and risk tolerance when planning their trading schedule.

Overlap Periods and Their Significance

The forex market experiences increased liquidity during overlap periods when multiple trading sessions are open simultaneously. This heightened activity can lead to greater volatility and tighter spreads, making it a potentially advantageous time for traders to capitalize on market movements.

- New York and London: 1 PM until 5 PM GMT

- Sydney and Tokyo: 1 AM until 7 AM GMT

- London and Tokyo: 8 AM until 10 AM GMT

During these overlaps, the combined volumes from multiple markets contribute to a more dynamic trading environment. Traders should be aware, however, that while opportunities increase, so does the risk associated with rapid price fluctuations.

The strategic importance of overlap periods cannot be overstated, as they represent the zenith of trading activity, offering a window of opportunity for those looking to execute large volume trades with minimal slippage.

Forex Market's Most Active Hours

The Forex market's most active hours are characterized by heightened trading volume and liquidity, making it a prime time for traders to execute their strategies. The peak of activity occurs when the New York and London sessions overlap, typically from 8am to 12pm EST (1 PM to 5 PM GMT). This period is renowned for offering more potential for profitable trading opportunities due to the significant increase in market movement.

During these hours, traders can expect higher liquidity for major currency pairs such as GBP/USD and EUR/USD. The European session alone is often considered the most active and liquid, given the extensive range of currency pairs being traded.

It's important for traders to be aware of these active hours to optimize their trading strategies and capitalize on the dynamic market conditions.

Here is a quick reference for the overlap periods:

- New York and London: 1 PM until 5 PM GMT

- Sydney and Tokyo: 1 AM until 7 AM GMT

- London and Tokyo: 8 AM until 10 AM GMT

While the Sydney and Tokyo sessions are less volatile, they still offer opportunities, especially for currency pairs more relevant to the Asia-Pacific region. The Tokyo session, being the first to open after the weekend, sets the initial tone for the week in Forex markets.

Weekend and Holiday Trading

Forex Market Closing Times

The Forex market observes a period of inactivity from the close of the New York session on Friday at 5pm EST until the opening of the Sydney session on Sunday at 5pm EST. This weekend closure is a unique characteristic of the Forex market, distinguishing it from other financial markets that may operate on a more traditional 5-day week.

During the week, each major trading session has its own closing time which can be crucial for traders to monitor:

- New York Session closes at 5:00 PM EST

- London Session ends at 12:00 PM EST

- Tokyo Session concludes at 4:00 AM EST

- Sydney Session wraps up at 2:00 AM EST

It's important for traders to be aware of these closing times to manage their trades effectively and avoid potential risks associated with holding positions over the weekend.

Additionally, a brief daily closure occurs from 16:59 to 17:05 New York time, during which all instruments are temporarily unavailable for trading. This brief pause allows for the reset of accounts and the prevention of unwanted order execution.

Impact of Weekends and Holidays on Forex Trading

While the forex market operates 24/5, providing continuous trading opportunities, it is closed during weekends and major holidays. The absence of trading during these times can lead to significant price gaps when the market reopens, as news and events continue to influence the markets even when trading is halted.

The impact of weekends and holidays on forex trading is an important consideration for traders, as it can affect trading strategies and risk management.

During these periods, traders may need to adjust their strategies to account for the possibility of market gaps. It is also essential to be aware of the trading hours in different time zones to effectively plan for the market's closing times.

- Monday: 00:00 — 23:00, 23:15 — 24:00 (CET)

- Tuesday to Thursday: 00:00 — 23:00, 23:15 — 24:00 (CET)

- Friday: 00:00 — 22:00 (CET)

These hours reflect the general schedule, but specific holiday closures can vary by country and may not be uniform across all forex markets.

Comparing Forex and Stock Market Hours

Overlap Between Forex and Stock Markets

The interplay between the forex and stock markets is crucial for traders who seek to optimize their strategies. Forex markets operate 24 hours a day during the week, providing continuous opportunities for trading. In contrast, stock markets, such as the NYSE and NASDAQ, have more restricted hours, typically from 9:30 AM to 4:00 PM EST, Monday to Friday.

The overlap in operating hours between these markets occurs during the New York forex session and the core trading hours for U.S. stocks. This period is significant as it can lead to increased liquidity and volatility, presenting both opportunities and risks for traders.

| Market | Forex (New York Session) | NYSE & NASDAQ |

|---|---|---|

| Opening Time (EST) | 8:00 AM | 9:30 AM |

| Closing Time (EST) | 5:00 PM | 4:00 PM |

| Days of Operation | Monday – Friday | Monday – Friday |

The overlap period is particularly important for traders who engage in currency pairs that involve the U.S. dollar, as market movements can be influenced by events in the U.S. stock markets.

Differences in Operating Hours

The Forex market operates 24 hours a day during the week, but not all hours are equally suitable for trading. The stock market, in contrast, has more defined opening and closing times based on the country's exchange.

Forex trading sessions overlap and can be accessed from anywhere in the world, which is not the case with stock markets that are tied to a physical trading floor. Here's a comparison of operating hours for major stock exchanges and the Forex market during standard and daylight saving times:

| Market | Standard Time (GMT) | Daylight Saving Time (GMT) |

|---|---|---|

| Sydney | 9 PM - 7 AM | 10 PM - 8 AM |

| Tokyo | 11 PM - 9 AM | Unaffected |

| London | 8 AM - 6 PM | 7 AM - 5 PM |

| New York (Forex) | 1 PM - 11 PM | 12 PM - 10 PM |

| New York (Stocks) | 2:30 PM - 9 PM | 1:30 PM - 8 PM |

Note that the Forex market's flexibility allows traders to respond to international events and news around the clock, which is a significant advantage over stock markets that may be closed during crucial events.

Additionally, the Forex market's hours are affected by daylight saving changes, whereas most stock markets maintain a consistent schedule throughout the year. This can lead to periods where the Forex market is more active just before the stock market opens or after it closes.

UTC Time and Its Relevance to Forex Trading

Understanding the role of Coordinated Universal Time (UTC) is crucial for Forex traders, as it serves as the benchmark for all trading hours globally. Forex markets operate around the clock, and UTC provides a consistent reference point for comparing the opening and closing times of different trading sessions.

The use of UTC in Forex trading helps to eliminate confusion that might arise from various local time zones, especially when trading involves multiple countries.

Here is a quick reference table for the Forex trading sessions in UTC:

| Forex Trading Session | Opening Time (UTC) | Closing Time (UTC) |

|---|---|---|

| New York Session | 13:00 | 22:00 |

| London Session | 08:00 | 17:00 |

| Tokyo Session | 00:00 | 09:00 |

| Sydney Session | 22:00 (Prev Day) | 07:00 |

Traders can use this information to plan their trading activities, ensuring they are active during the hours when the markets they are interested in are open. Additionally, understanding UTC time helps in identifying the best times to trade based on one's location and the corresponding local time.

Conclusion

In conclusion, the forex market operates 24 hours a day, five days a week across four major trading sessions in different time zones. Traders can take advantage of the overlapping trading hours between major markets to capitalize on higher trading volumes and potential profitable opportunities. Understanding the opening and closing times of the forex market is crucial for effective trading strategies and maximizing trading activity. Utilizing tools like the Forex Market Time Zone Converter can help traders navigate the different trading sessions and optimize their trading schedules. Overall, being aware of the forex market hours and the best times to trade can enhance trading performance and profitability for traders in the global forex market.

Frequently Asked Questions

What time does the forex market open and close?

The forex market operates 24 hours a day, five days a week. It opens on Monday and closes on Friday, with major trading sessions starting at different times depending on the location.

What are the best times to trade forex?

The best times to trade forex are during the overlap periods of major trading sessions, particularly when the New York and London sessions coincide. This is when trading volume is highest.

How do forex market hours compare to stock market hours?

Forex markets are open 24 hours a day, five days a week, while stock markets have more restricted operating hours. There is an overlap between stock market and forex market opening hours.

What is UTC time and its relevance to forex trading?

UTC (Coordinated Universal Time) is the primary time standard used globally to regulate clocks and time. Forex trading sessions are often converted to UTC time for reference across different time zones.

Are forex and stock markets open at the same time?

There is an overlap between stock market and forex market opening hours, but stock markets have more limited operating hours compared to the forex market.

How can I use a Forex Market Time Zone Converter?

A Forex Market Time Zone Converter tool can help traders visualize the different trading sessions in various time zones, allowing them to plan their trading activities effectively.

Social Plugin